How to submit a voluntary disclosure electronically? A step by step instruction

Are you afraid of penal and fiscal consequences due to unpaid taxes or failure to submit a tax return? You have a chance to avoid a severe penalty - you can submit the so-called 'Voluntary disclosure' without leaving your house. The voluntary disclosure procedure will not release you from fulfilling your obligations towards the head of the Tax Office (or the customs and tax office), but it may save you from unplanned budget depletion. How to submit the document electronically? We advise you on how to do it and explain who can benefit from submitting a voluntary disclosure.

How to submit an active resentment electronically? A step by step procedure.

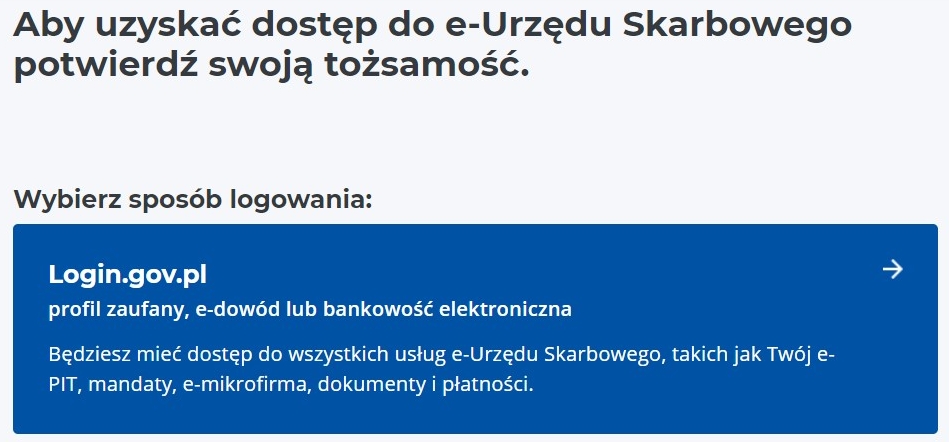

First, log into the Tax Office website:

https://www.podatki.gov.pl/e-urzad-skarbowy/

Click on 'e-Tax Office - log in' (PL - "e-Urząd Skarbowy – zaloguj się")

.jpg)

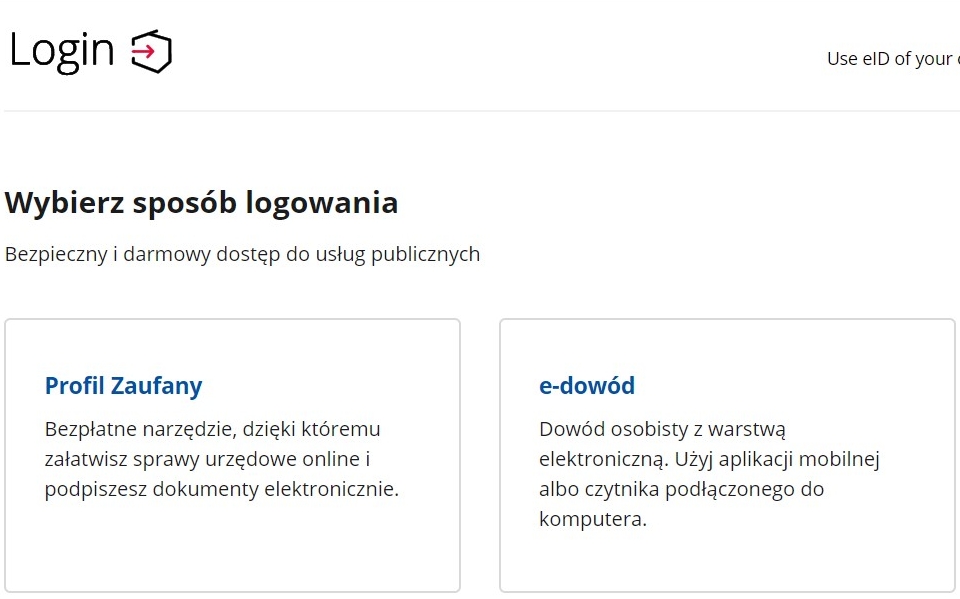

Choose the method of logging in - 'Login.gov.pl'.

You can log in in 3 ways: through a trusted profile, e-identity card or through electronic banking.

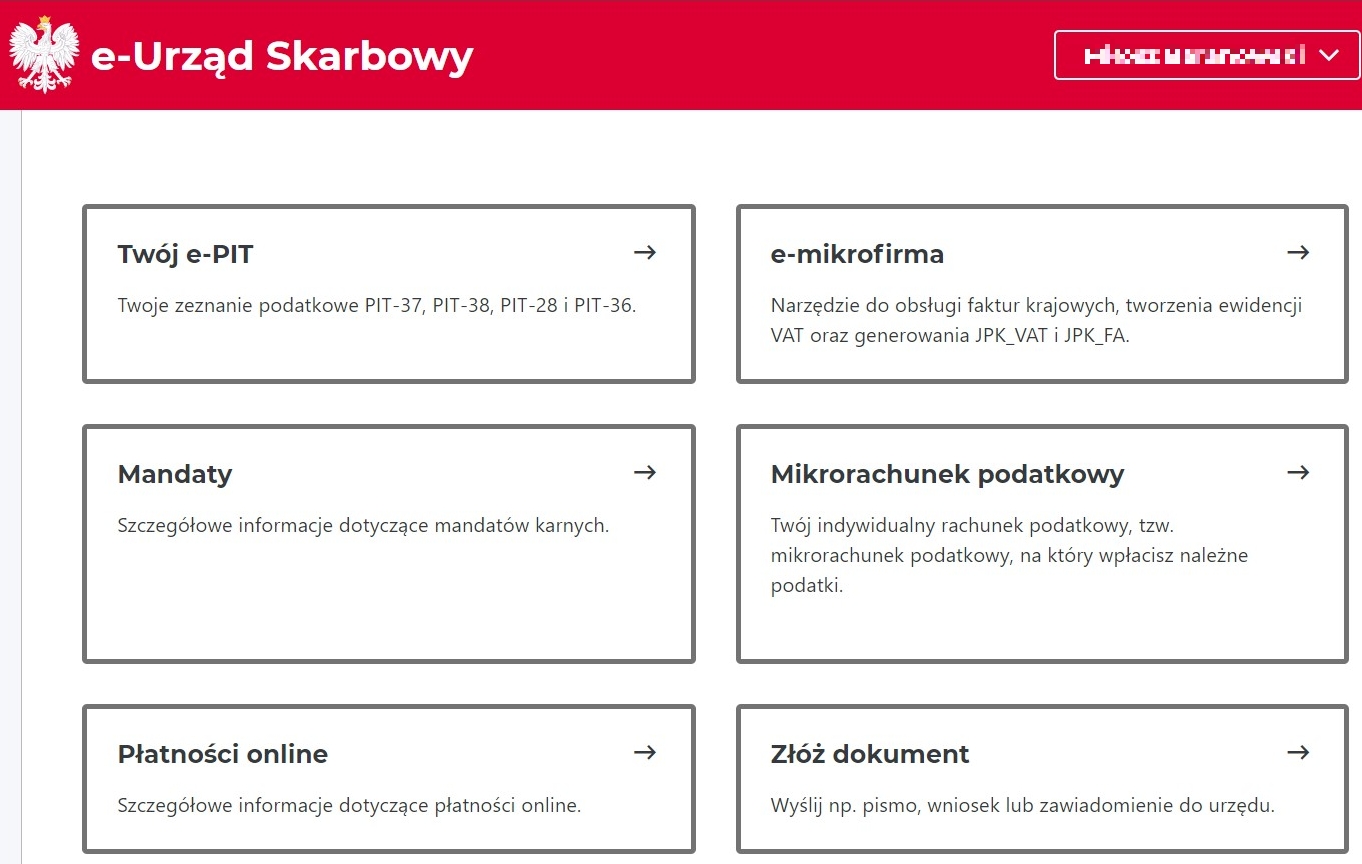

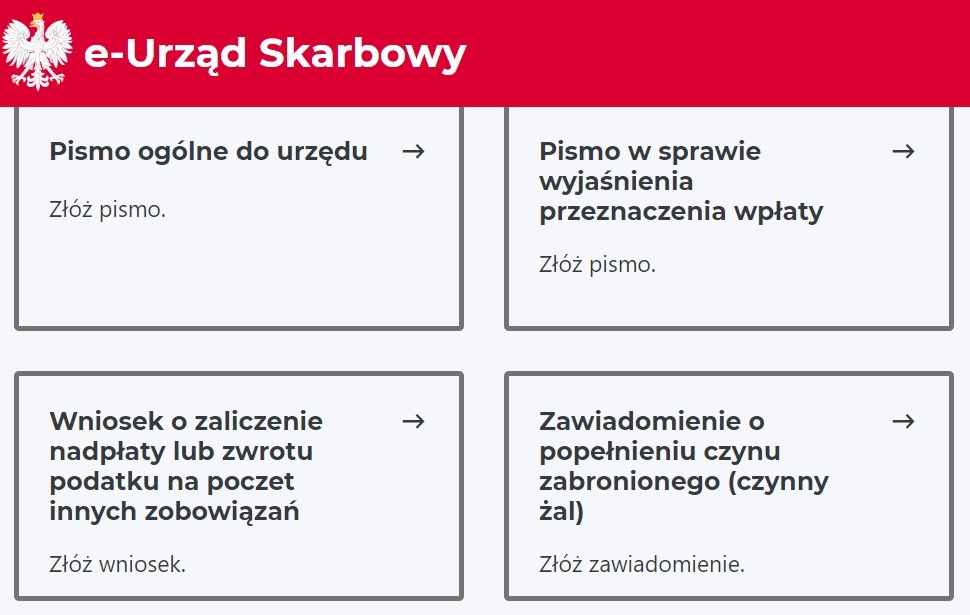

Once you move to your account, select the 'Submit the document' option (PL - "Złóż dokument")

Next click on the 'Notification of the commission of a prohibited act (voluntary disclosure)' (PL - "Zawiadomienie o popełnieniu czynu zabronionego (czynny żal)")

Voluntary disclosure - what do you need to know?

You can submit a voluntary disclosure at any time but it must be considered effective for you to avoid being punished. You cannot upload a voluntary disclosure if:

• The tax authorities have documented the fact that you have committed a tax offense or a fiscal offense;

• The relevant authorities have already started their official activities in your case;

• You have received a summons regarding a fiscal misdemeanor or crime;

• There is evidence that you induced another person to commit a misdemeanor or fiscal offense;

• You are the organizer of a group (or association) whose purpose is to commit a tax offense.

If you submit a voluntary disclosure - that is, you voluntarily notify about committing a prohibited act - and fulfill the obligations that are still incumbent on you, the head of the Tax Office may waive the penalty. Remember to describe exactly what the prohibited act is about, provide important details about the circumstances of the committed act and - what is equally important - fulfill your obligations (especially making payments, if you are in arrears with any).

(2).png)