(1).png)

The New Polish Order and taxes for entrepreneurs. What changes?

The New Polish Order will introduce many changes for companies — including quite significant ones for the sole proprietorship. Some reforms will come into force in the new fiscal year, and some will take effect later this year. What will change for entrepreneurs? The New Polish Order — what changes will it bring (and which should be prepared in advance)? We explain.

New Polish Order and Taxes — What entrepreneurs can expect

The Ministry of Finance has presented a bill that will change a lot in terms of taxes. The lowest earners will benefit from the changes. The group of entrepreneurs with high incomes will be strongly affected by the reform. The most important tax changes are:

• The tax-free amount will increase — up to PLN 30,000;

• The first tax threshold will increase — from PLN 85,528 to PLN 120,000 of annual income;

• Health contributions will be as follows: 9% for the people paying on general terms and 1/3 of the flat rate for people paying at a flat rate;

• The health contribution will not be tax-deductible;

• The so-called 'Middle-class relief' will be introduced — but by definition, it will not apply to people who earn income from civil law contracts or from economic activity (including their own business);

• R&D and IP Box allowances are to be merged;

• There will be a 'return relief' for entrepreneurs transferring their businesses to Poland or returning from abroad — they will pay only 50% PIT for 2 years after their return.

With the entry into force of the reforms of the New Polish Order (i.e., January 1, 2022), entrepreneurs — especially those with higher incomes — will feel the consequences on their wallets.

New Polish Order — the tax on general principles

According to the Ministry of Finance announcements, entrepreneurs can expect significant changes in taxes. We present them below (for a better picture of the situation — in tables and the form of charts).

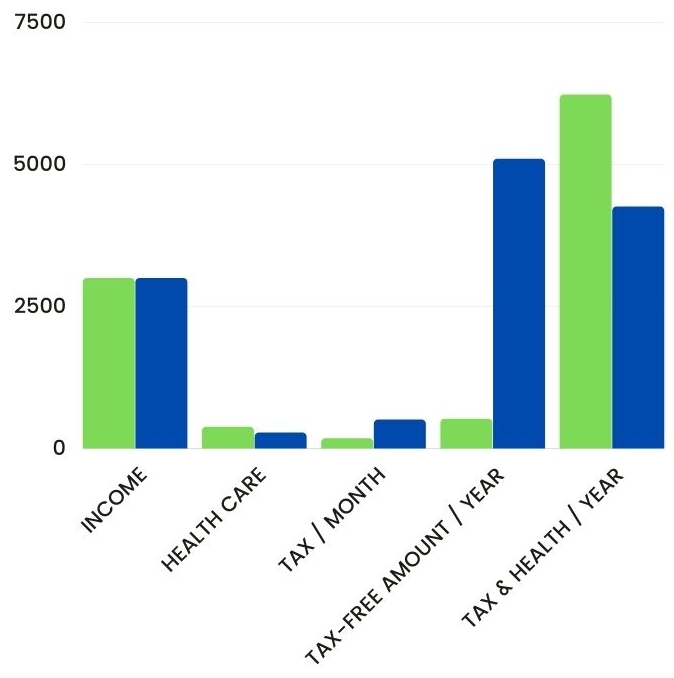

The New Polish Order and the tax on general principles:

|

CONTEXT |

INCOME/ MONTH |

HEALTH CARE CONTRIBUTION |

TAX /MONTH

|

TAX-FREE AMOUNT / YEAR |

TAX AND HEALTH CONTRIBUTIONS / YEAR |

|

CURRENTLY |

3 000 PLN |

381 PLN |

182 PLN |

525 PLN |

6 231 PLN |

|

NEW POLISH ORDER |

3 000 PLN |

279 PLN |

510 PLN |

5 100 PLN |

4 260 PLN |

Green: current level. Blue: projected level after the introduction of the New Polish Order.

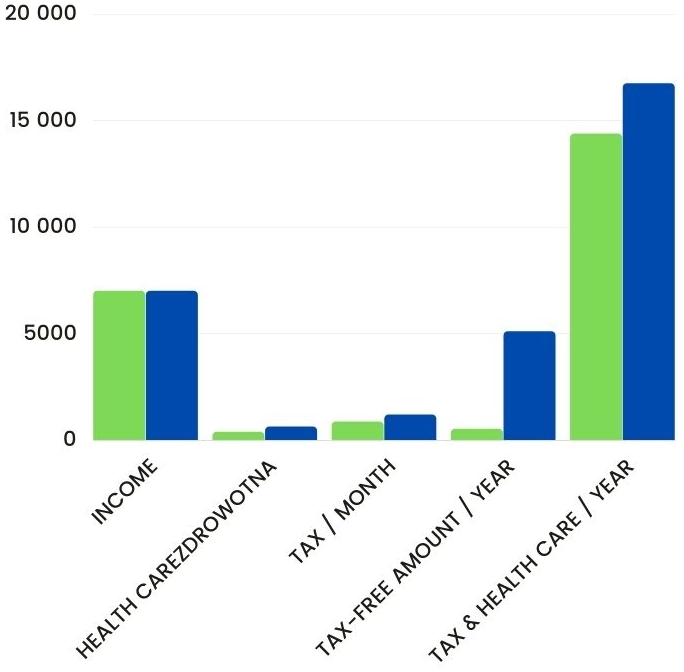

|

CONTEXT |

INCOME/ MONTH |

HEALTH CARE CONTRIBUTION |

TAX /MONTH

|

TAX-FREE AMOUNT / YEAR |

TAX AND HEALTH CONTRIBUTIONS / YEAR |

|

CURRENTLY |

7 000 PLN |

381 PLN |

862 PLN |

525 PLN |

14 391 PLN |

|

NEW POLISH ORDER |

7 000 PLN |

630 PLN |

1190 PLN |

5 100 PLN |

16 740 PLN |

Green: current level. Blue: projected level after the introduction of the New Polish Order.

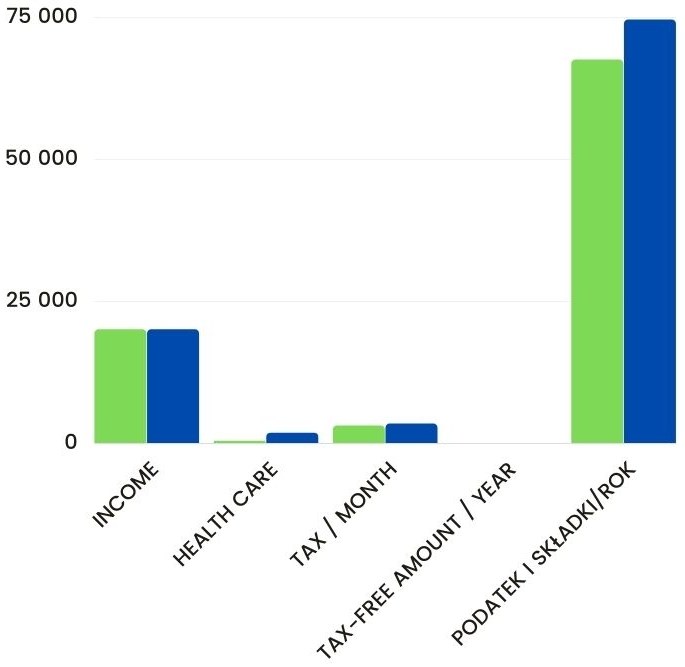

|

CONTEXT |

INCOME/ MONTH |

HEALTH CARE CONTRIBUTION |

TAX /MONTH

|

TAX-FREE AMOUNT / YEAR |

TAX AND HEALTH CONTRIBUTIONS / YEAR |

|

CURRENTLY |

20 000 PLN |

381 PLN |

3 072 PLN |

- |

67 512 PLN |

|

NEW POLISH ORDER |

20 000 PLN |

1 800 PLN |

3 400 PLN |

- |

74 540 PLN |

Green: current level. Blue: projected level after the introduction of the New Polish Order.

Flat tax and the New Polish Order

The situation of entrepreneurs settling based on a flat tax is slightly different — the differences relate to Social Security contributions and their settlement. The New Polish Order is as follows for this group:

|

CONTEXT |

INCOME/ MONTH |

HEALTH CARE CONTRIBUTION |

TAX /MONTH

|

|

|

CURRENTLY |

3 000 PLN |

381 PLN |

242 PLN |

7 476 PLN |

|

NEW POLISH ORDER |

3 000 PLN |

279 PLN |

570 PLN |

10 188 PLN |

|

CONTEXT |

INCOME/ MONTH |

HEALTH CARE CONTRIBUTION |

TAX /MONTH

|

|

|

CURRENTLY |

7 000 PLN |

381 PLN |

1 002 PLN |

16 596 PLN |

|

NEW POLISH ORDER |

7 000 PLN |

630 PLN |

1 330 PLN |

23 520 PLN |

|

CONTEXT |

INCOME/ MONTH |

HEALTH CARE CONTRIBUTION |

TAX /MONTH

|

|

|

CURRENTLY |

20 000 PLN |

381 PLN |

3 472 PLN |

46 236 PLN |

|

NEW POLISH ORDER |

20 000 PLN |

1 800 PLN |

3 800 PLN |

67 200 PLN |

The above calculations do not include social contributions. The amount is approximately PLN 1,000. These contributions are and will continue to be paid by entrepreneurs.

New Polish Order and lump-sum tax

The New Polish Deal in terms of lump-sums will not bring many changes. An important reform is the issue of health insurance premiums for entrepreneurs paying lump sum — the amount of health insurance premium will be 1/3 of the lump sum. In addition, the amounts of health insurance contributions paid will not be tax-deductible.

New Polish Order — sole proprietorship

Despite the announcement that 18,000,000 people will benefit from the changes, the New Polish Deal is not a good change for many sole proprietorship owners. By definition, the legislator discourages concluding civil law contracts. A painful change from the packages of the New Polish Order is the bypassing of entrepreneurs obtaining income from business activities and civil law contracts in the context of 'middle-class relief'.

This relief will apply to those earning from PLN 68,412 to PLN 133,692 per year (PLN 5,700—11,140 per month), but only based on an employment contract. Thus, — those entrepreneurs from this income bracket have no chance of compensating for the losses caused by the lack of tax deduction for health insurance contributions. The question arises — is it better in such a situation to set up a company or transfer a sole proprietorship outside Poland — for example to the Czech Republic? Everyone who asks this question — we invite you to contact us. Our TaxCoach experts will suggest the best solution in this matter.

.jpg)

.jpg)

.jpg)